net investment income tax brackets 2021

Interest from municipal bonds is generally tax-free on. The net investment income tax is a 38 surtax that is paid in addition to regular income taxes.

All About Net Investment Income Tax

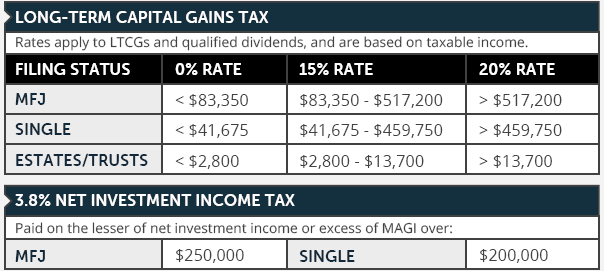

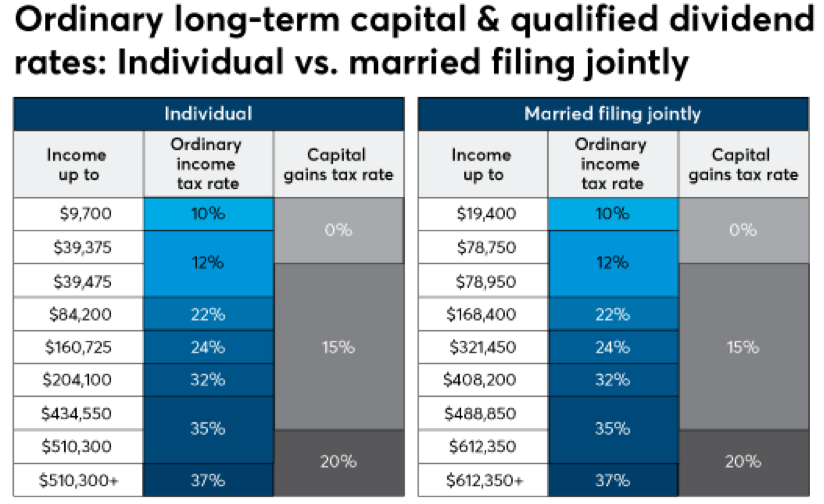

In addition to these rates a 38 net investment income tax is assessed on the capital gains of high earners regardless of whether they are long- or short-term in nature.

. Federal income tax rate. 10 on taxable income. Some interest income is tax-exempt though.

In the US short-term capital gains are taxed as ordinary income. Total section 1411 NOL allowed as deduction against 2021 net investment income 55000 In 2021 the regular income tax NOL remaining from 2019 has reduced the taxpayers income for regular income tax to 490000. Taxpayers use this form.

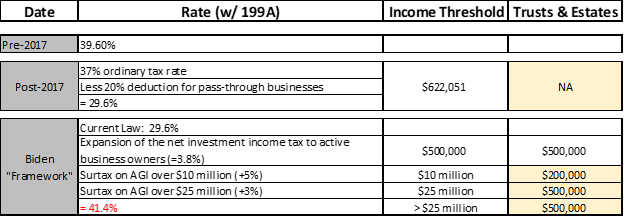

The Net Investment Income Tax NIIT or Medicare Tax applies at a rate of 38 to certain net investment income of individuals estates and trusts that have income above. The undistributed net investment. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers.

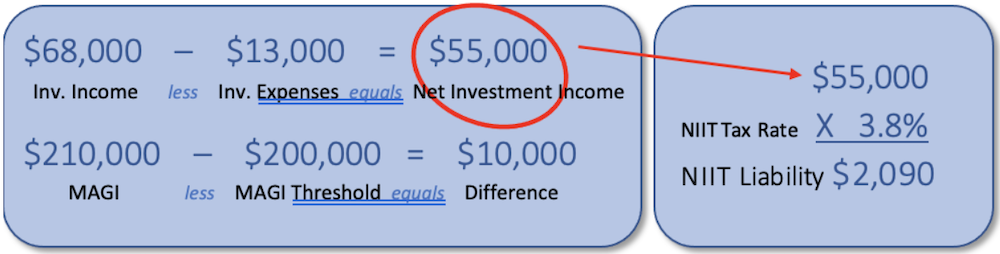

Individuals with MAGI of 250000 married filing jointly or 200000 for single filers are taxed at a flat rate of 38 percent on investment income such as dividends. Net investment income includes interest dividends annuities royalties certain rents and. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers.

That means you could pay up to 37 income tax depending on your federal income tax bracket. The Net Investment Income Tax shouldnt be an everyday or every year thing it applies to investment income above a fairly large threshold. The NIIT is 38 of the lesser of.

Undistributed net investment income and adjusted gross income AGI in excess of the threshold amount. The individual is entitled to reduce his net investment income by 55000 entered as a negative amount on Form 8960 line 7. The NIIT is equal to 38 of the net investment income of individuals estates and certain trusts.

The excess of modified adjusted gross income over the following. Tax status NIIT Threshold. 995 12 on the amount over 9950.

The net investment income or. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file.

2023 Federal Income Tax Brackets and Rates for Single Filers Married Couples Filing Jointly and Heads of Households. The foundation is liable. 1 It applies to individuals families estates and trusts.

In the case of an individual the NIIT is 38 percent on the lesser of. If the foundation were tax exempt it would have a 4000 liability for tax on net investment income and a 7000 liability for tax on unrelated business income. The adjusted gross income over the dollar amount.

Those rates range from 10 to 37 based on the current tax brackets. Tax Rate For Single Filers For Married Individuals. But not everyone who makes income from their investments is impacted.

How Are Capital Gains Taxed Tax Policy Center

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Understanding The New Kiddie Tax Journal Of Accountancy

Summary Of The Latest Federal Income Tax Data Tax Foundation

Investor Education 2021 Tax Rates Schedules And Contribution Limits

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Investment Expenses What S Tax Deductible Charles Schwab

Easy Net Investment Income Tax Calculator

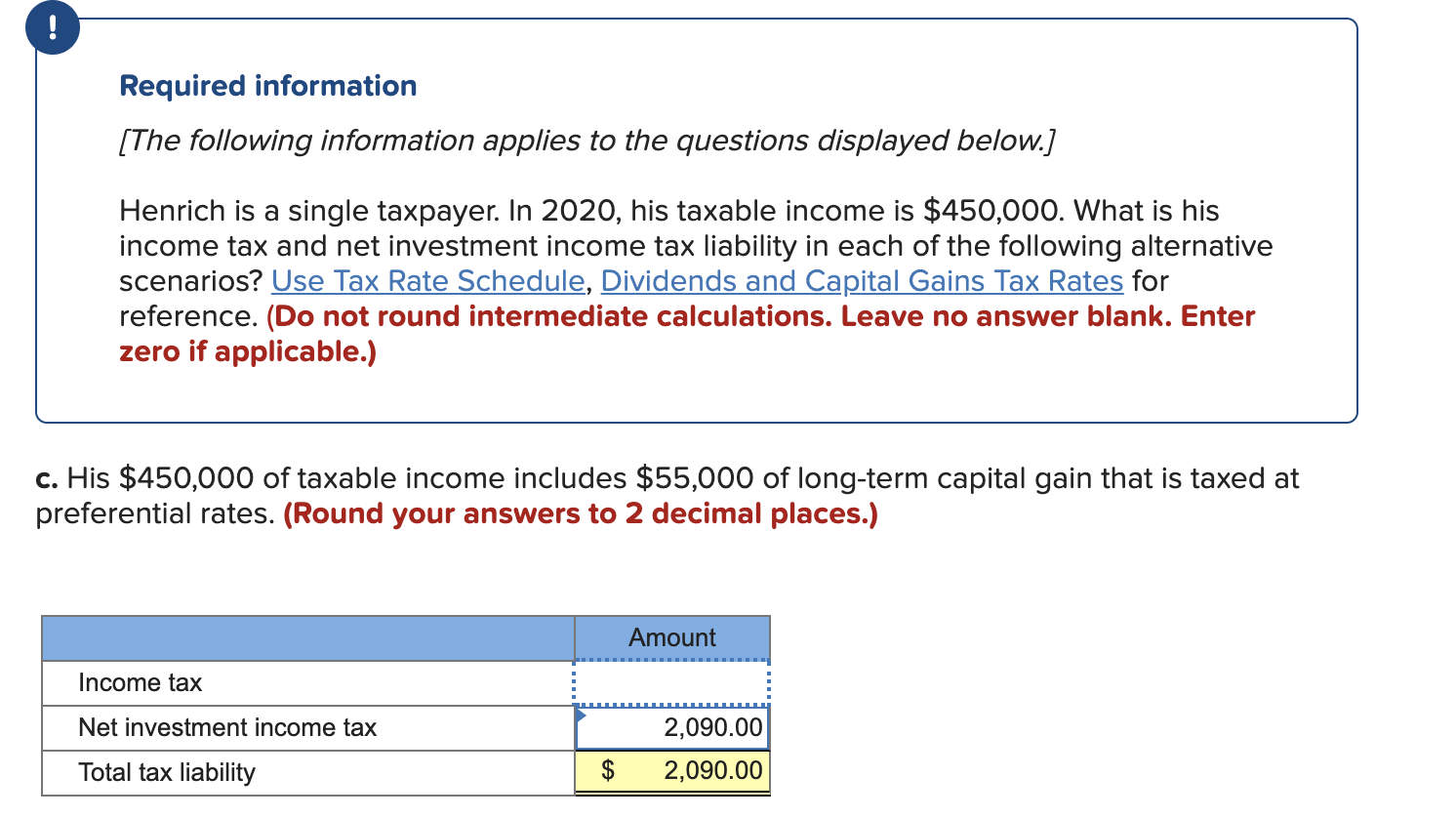

Solved Required Information The Following Information Chegg Com

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans Cea The White House

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

Capital Gains Tax In The United States Wikipedia

Assault On Family Businesses Continues The S Corporation Association

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Real Estate Capital Gains Tax Rates In 2021 2022

Easy Net Investment Income Tax Calculator

Capital Gains Tax Rates For 2022 Vs 2023 Kiplinger

Consider Taxes In Your Investment Strategy Rodgers Associates